In order to play with bookmaker, it is important point which payment method is used.

In the case of a bookmaker who uses real money to make a bet, it takes a lot of time and effort to deposit and withdraw money, resulting in great stress.

Currently, a number of payment methods have been adopted by bookmakers, but one that has recently been attracting attention is STICPAY, which will be introduced this time.

As a matter of fact, this STICPAY has become "it is possible to withdraw from ATM", and it is expected that it will be introduced by many bookmakers in the future because it is very convenient.

In this article, we will thoroughly explain the characteristics of STICPAY, how to register, fees, deposit and withdrawal methods, etc., so let's keep the basic information down.

Feature of STICPAY

STICPAY is an online payment service that is used by millions of users in a wide range of countries such as Europe and Asia.

In addition, it is also famous for having a business partnership with "Sunderland (Sunderland) AFC" belonging to the world's most popular soccer league, Premier League.

Such STICPAY has many advantages as follows.

- You can deposit and withdraw through the bookmaker

- You can withdraw from ATM

- MasterCard can be used in various places such as shopping at a member store, online shopping, remittance to overseas banks, forex trading etc.

Today, bookmakers such as "1X BET" and "Sports BET Io" have already introduced STICPAY as a payment method.

How to register STICPAY

In order to use STICPAY, you must first register a new account.

Follow the steps below to complete the registration process.

"STICPAY account registration procedure"

1 Access to the website of STICPAY

First, access to the STICAPAY home page.

2 Click “Sign UP”

Next, click on "Sign UP" at the top right of the screen.

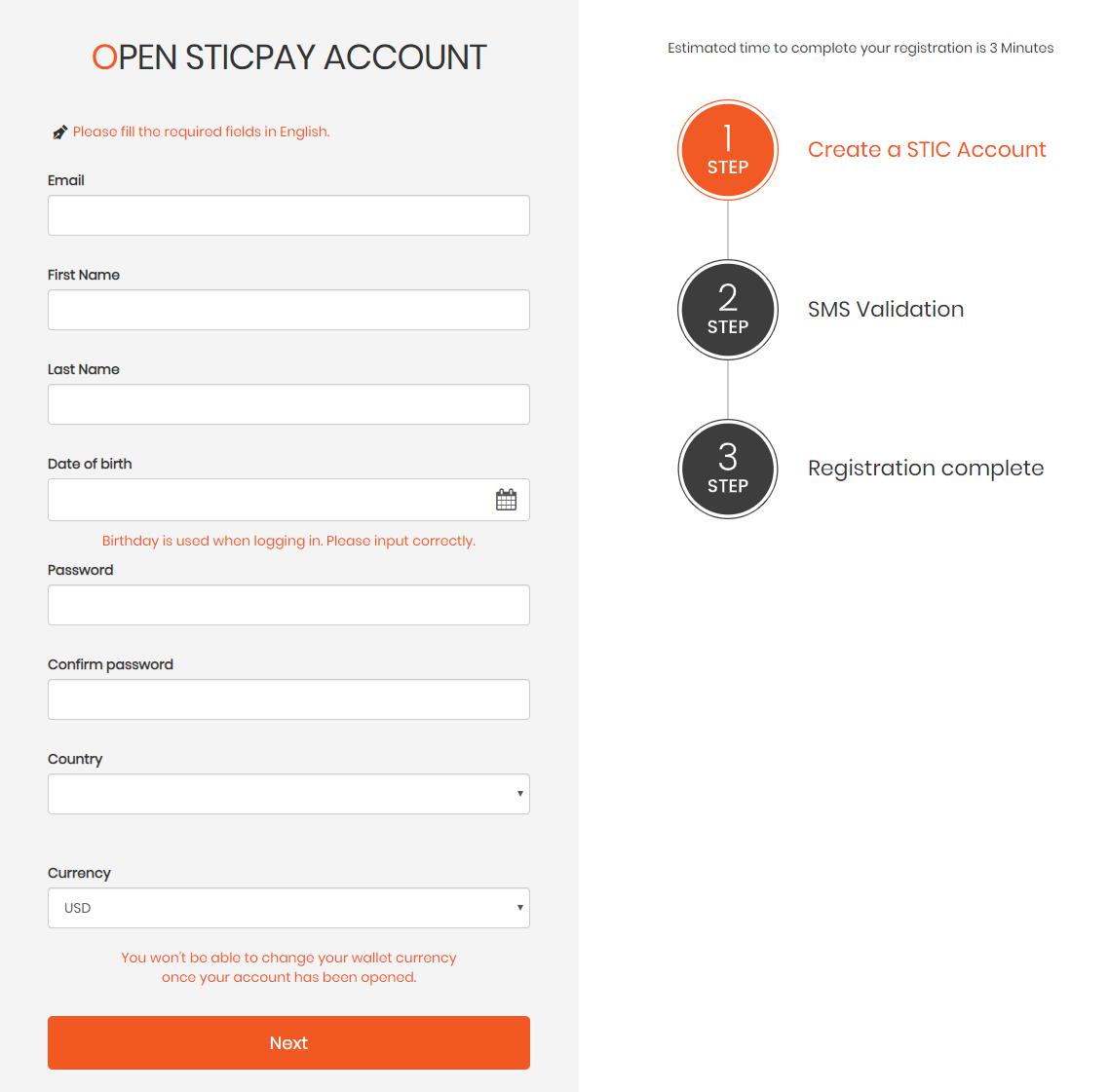

3 Enter various information

When the screen changes, let's enter various information such as name, address, password.

Also, be aware that the input is alphanumeric rather than Japanese.

When you have made all your entries, click "Next."

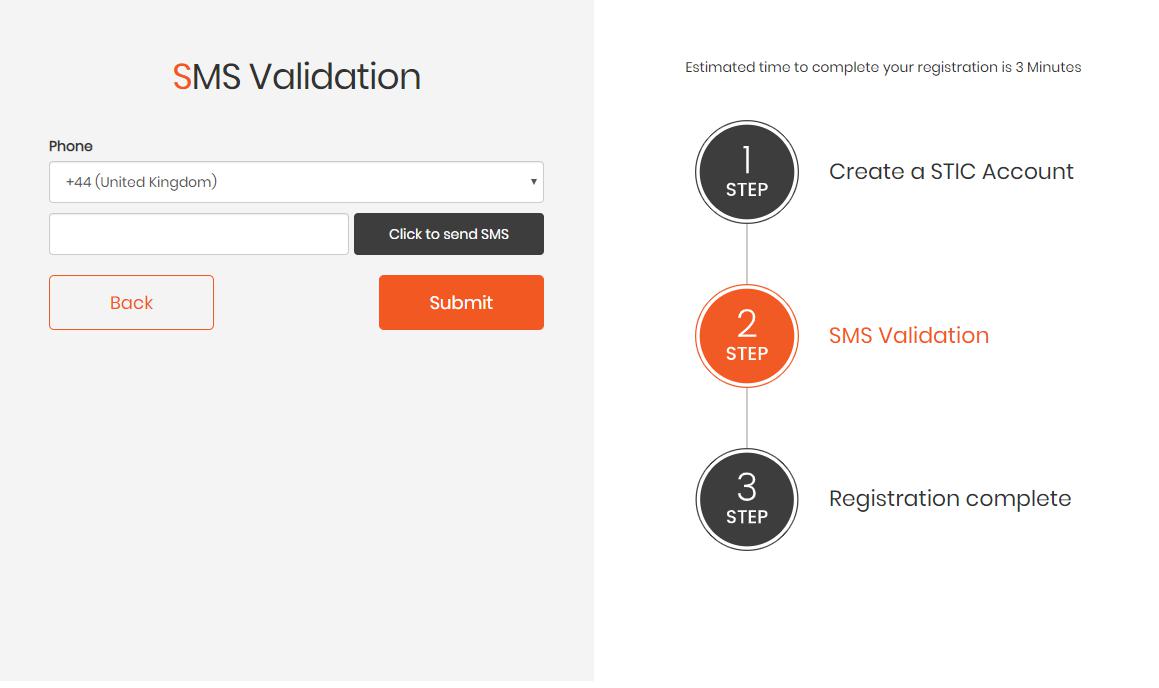

4 SMS authentication

Next to entering information is SMS authentication.

Enter your mobile phone number and click "SMS Shipping".

Then, the code will be sent to the number, so enter the code and perform "Code check". After confirmation is complete, click "Send".

5 Complete account registration

completed successfully. In addition, because the amount of withdrawal and transfer is limited at this point, we recommend that you submit your identification and residence certificate as soon as possible in order to fully utilize the service.

・ Recommended currency is HKD (Hong Kong dollar)

It is the currency of the account that is likely to be decided somehow when creating an account, but it is actually related to each fee, so it is possible that it will be better to choose a currency that matches the payment service.

And, in the case of Stick Pay, it is recommended to select “HKD (Hong Kong Dollar)”. The reason is that Stickpay only allows you to select HKD card currency. If you choose other currencies, you will have more opportunities for exchange fees.

Also, even if you have chosen another currency at the moment, there is no problem if you create a new account with HKD again. However, be aware that you can not use an address that has already been registered.

STICPAY fee

| Means of deposit | Commission rate |

| Overseas bank remittance | 1% |

| Credit card | 3.85% |

| Bit Coin | Free |

| Free from Merchant saite (bookmaker, online casino etc) | Free |

| Means of withdrawal | Commission rate |

| Overseas bank transfer | 5% |

| ATM | Minimum $ 4 or 1% of withdrawal amount |

| Stick paycard | 1.3% (However, the actual fee is about 5.3% because the fee from StickPay account to Stickpaycard is 1.3% and the exchange fee and deposit fee are about 2% separately) |

| Free from Merchant saite (bookmaker, online casino etc) | 2.5% + $ 003

|

| sub-account | 1% (up to $ 35) |

| between individuals | 1% (up to $ 35) |

| Currency conversion (dollar to euro, etc., fees charged when exchange is required) | About 2% |

| Card issuance fee | $ 35 |

Use limit of STICPAY

Because STICPAY has a credit limit, it is not possible to withdraw money infinitely.The limits are as follows.

| ATM withdrawal limit |

|

| Settlement limit |

|

-A passport is required to issue a card

Although it is the biggest advantage of Stick Pay that you can withdraw ATM, "Submission of passport" is essential to issue a card. Therefore, you can not make a card if you do not have a passport. The following documents need to be submitted to issue a card.

※ From February 2019 STICPAY cards can not be issued.

"Required documents for issuing cards"

1. Passport

・ Passport within the expiration date (but not that of the maiden name)

2. Identification card (with face picture)

- -Driver's license,

- photo included resident card, etc.

3. Address certificate (within 3 months of being issued)

- Resident card

- Receipt of utility charges

- Credit card and bank statement

- Tax payment certificate etc.

STICPAY payment method

When making a deposit with STICPAY, it is recommended to deposit with a bitcoin that does not require a fee. (Credit card charges 1.3%)

The deposit procedure using Bitcoin is as follows.

"Payment procedure (bitcoin)"

1 Login to my account

First, log in to My Account from the Bitcoin homepage.

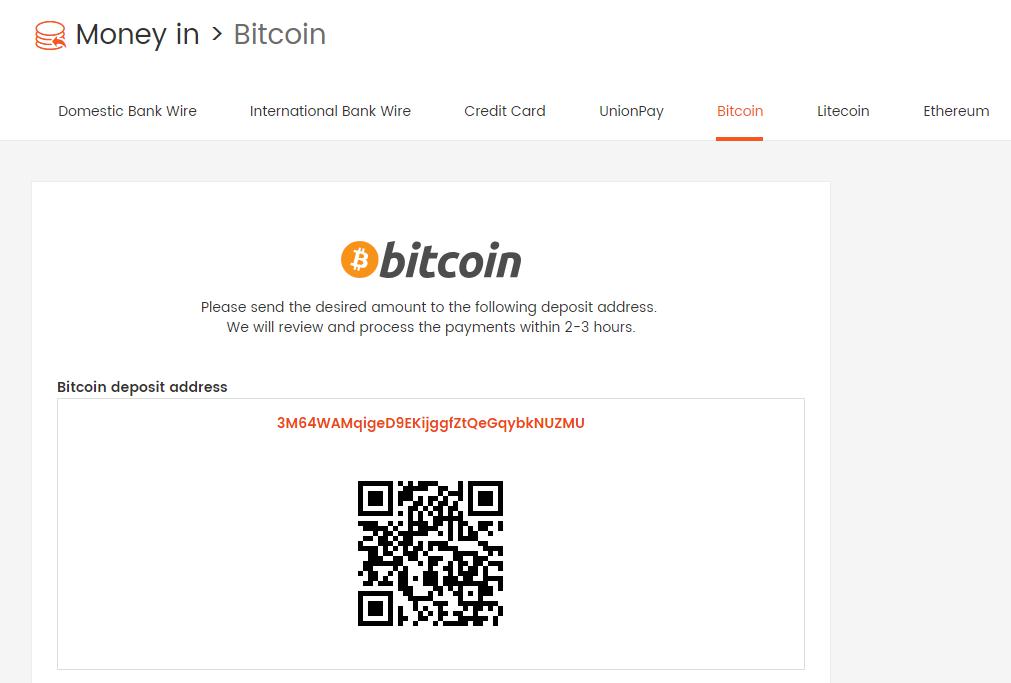

2 bitcoin deposit address

Click "Payment → Bitcoin" on the left side of My Account page to display the bitcoin address.

3 Send money to the displayed address

Finally, send a bitcoin to the displayed address and payment will be complete.

How to withdraw from STICPAY

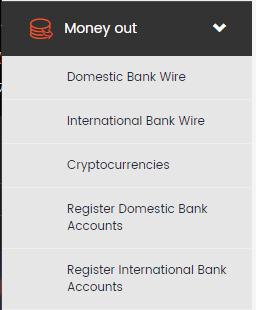

The following methods are available as a payment method for STICPAY.

- Overseas bank transfer

- Alternative payment means (NETELLER, Skrill)

- ATM withdrawal (STICPAY card)

Although domestic bank remittances were possible until a while ago, with the withdrawal being suspended now, I will introduce the procedure of "overseas bank remittance"

here. The withdrawal procedure is as follows.

"Payment procedure (overseas remittance)"

1 Login to my account

log in to your account.

2 Register bank account

Next, select "Withdrawal → Register bank account number" to register the overseas recipient bank account.

3 Enter and complete withdrawal information

Once you have registered your overseas recipient bank account, click on “Withdraw → Bank Transfer” and select the account you just registered.

Finally, if you enter information such as withdrawal amount, withdrawal will be completed.

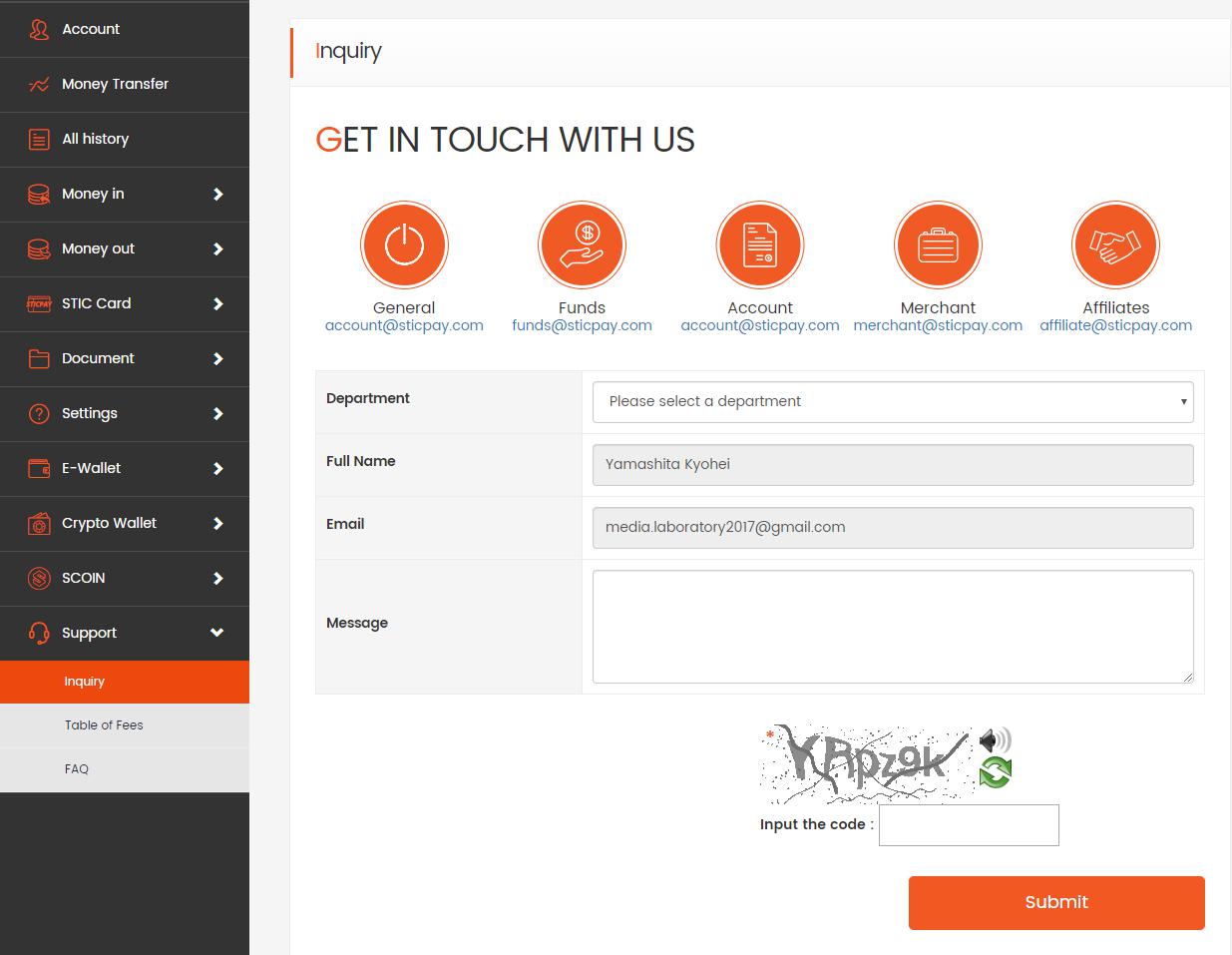

・ Unsure use support

It will be correspondence by e-mail, but the speed of reply is fast and the content of reply is very polite and easy to understand. Naturally, you can make inquiries free of charge, so if you encounter any questions or problems, use them positively.

In addition, support inquiries can be made from "support → inquiries" in the lower left of my account.

As described above, it was "explained how to register, deposit and withdraw money online payment service" STICPAY"!